YC has a famous motto: “make something people want.”

This is a great launching point for startup strategy. But when you get into the nitty-gritty, a few important questions pop up:

How do you know for certain that what you are making is something people want?

How do you know this will translate into a scalable business?

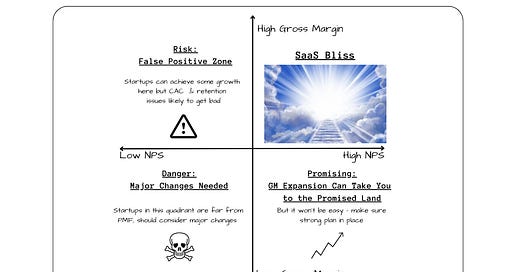

For a SaaS startup, the short answer is:

High NPS and high gross margins = SaaS Bliss

#1 - NPS

Most seed-funded startups I meet think they are making a product that people want. Yet most struggle to get significant customer demand. In other words, the vast majority of startup founders overestimate the desirability of their product. That’s why I’m such a big fan of Net Promoter Score. NPS is premised on the idea that the best measure of product quality is word-of-mouth. Using a simple method of comparing a product’s ratio of “promoters” to “detractors, ” NPS brings objectivity to the otherwise ambiguous question of product quality.

Depending on who you ask, some might consider an NPS score of 30 to be “good.” A score of 40 or 50 is solidly in the range of “good to very good.” But a truly great NPS is 60 or higher. A score this high essentially means that in a group of 10 customers, if there is 1 unhappy customer then there are 7 extremely happy customers who will tell their peers about your product.

Startups with an NPS of 60+ are in a wonderful position. Not only have they achieved tight product-market-fit (PMF), they have a robust platform for efficiently scaling sales & marketing - typically the hardest cost center to manage over time.

When most users are net promoters of your product, it boosts the ROI of every single dollar spent on sales & marketing. This makes it much easier to be cash flow positive over time. You won’t have to spend through the nose on customer acquisition to maintain growth.

#2 Gross Margins

It’s possible to generate a high NPS by giving away lots of free stuff. How to make sure this isn’t happen? Have high gross margins.

The beauty of the SaaS business model is that gross margins are, theoretically, very high. The cost of a licensing a series of 1’s and 0’s over the Internet is close to zero. Yet many SaaS startups struggle with gross margins. They might be giving away services that sabotage their unit economics. Perhaps their cost of compute eats into a bunch chunk of revenue.

What constitutes high gross margins? The tricky thing about gross margins for SaaS startups is that they often are quite low at an early stage. But they typically get a lot better with scale. For a SaaS startup in the 1-10m ARR range, 40-50% gross margins could be considered solid. At 60%, a startup in the 1-10m ARR range is doing great. They are likely well on their way to hitting 75-80% gross margins by the time they reach 100m ARR.

Conclusion: Snowflake Puts It All Together

Like with NPS, an early stage SaaS startup wants to be at 60+ for gross margins. If you’re a SaaS startup in the 1-10m ARR range, the 60/60 Club is the most elite company you can find.

Since it’s very difficult to do a deep dive in a private company’s gross margins & NPS, let’s look at Snowflake, one of the best public SaaS companies. Snowflake is a good example of the potential for gross margin expansion at scale. They had a relatively low gross margin in 2019 at $96m in revenue:

In 2019, Snowflake’s NPS was a remarkable 74. In 2022, it’s a similarly phenomenal 72. With a product so beloved, it’s no surprise that Snowflake can achieve rapid growth with relatively modest spend on sales & marketing.

In their most recent quarter, Q4 of their fiscal 2023, Snowflake grew product revenue by a robust 54% and only spent 38% of revenue on sales & marketing. With a gross margin of ~75%, that leaves a meaty 37% of revenue to cover R&D and G&A. A strong management team like Snowflake’s can easily cover those costs and still generate a healthy profit.

Since customers typically pay Snowflake upfront, their incoming cash receipts exceed their revenue figure. This means they have even more room to invest in the business and generate significant cash flow - which they did, generating an impressive free cash flow margin of 24% in the past year. That’s the beauty of high NPS & high gross margins. The combination enables strong growth & significant cash flow, the hallmarks of a truly elite business. Snowflake is enjoying SaaS Bliss.

Snowflake's was legendary! Great read thanks :)