Weekly Update: Markets Calm, AI Continues to Surge

Highlights from a SaaS VC on the week of 4/17

Happy Saturday!

In this edition of the Weekly Update, you’ll find:

Market Update

Tech Deal of the Week

Pod of the Week

Article of the Week

AI Update

Special Section: Elon Update

I. Market Update:

For the second week in a row, the WCLD cloud index was flat - it closed the week at $28.16. Like last week, the markets were flat-to-up. The S&P index was flat on the week while the NASD was up 3.5%.

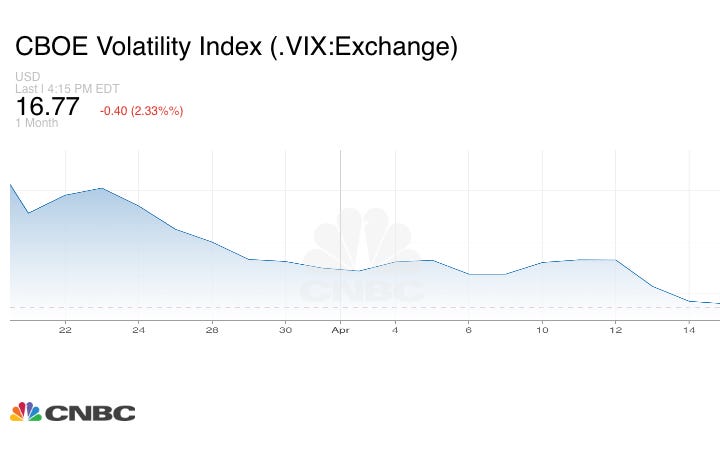

The major story of the market over the last month is the return of calm after the SVB crisis. The VIX, the major index of market volatility, has steadily trended down:

While inflation continues to be a major concern in some places - such as the UK, which had a 10.1% CPI reported in March - in the US, the market’s concerns have shifted from inflation to recession.

A recent Bloomberg article addresses recent credit tightening:

Small businesses say it hasn’t been this difficult to borrow in a decade; the amount of corporate debt trading at distressed levels has surged about 300% over the past year, effectively locking a growing swath of businesses out of financial markets.

While credit conditions signal risk, US unemployment continues to be extremely low:

A dozen US states saw their unemployment rates fall to a record low last month, according to new data from the Bureau of Labor Statistics…The data point to persistent strength in the US labor market, suggesting that a recession may not be as imminent as some analysts are predicting.

While the Fed will probably hike one more time, even the most aggressive inflation fighters recognize it’s time to ease up:

Cleveland Fed President Loretta Mester, typically among the more hawkish of policymakers, said she favored getting rates above 5% because inflation was still too high…

“We are much closer to the end of the tightening journey than the beginning,” she told an audience in Akron, Ohio on Thursday. “How much further tightening is needed will depend on economic and financial developments and progress on our monetary policy goals.”

What all of this mean for SaaS and startups? It’s a mixed bag.

A recessionary environment this year means that SaaS vendors will have to navigate tighter customer budgets. OTOH the sooner recessionary pressure appears, the sooner the Fed will cut. Cheaper money will push assets towards risk, creating a tailwind for valuations. I suspect 2024 will be a better year for exits than 2023.

II. Tech Deal of the Week: The Next AI Juggernaut

Since its launch a few months ago, open source startup LangChain’s growth has been vertical. Its GitHub star growth nicely reflects its rapid adoption:

I’ve been amazed by LangChain’s speed and high-quality execution. Many VC’s share a similar opinion:

Just a week after announcing a $10 million seed investment from Benchmark, AI darling LangChain has scored even more capital from yet another top-tier VC.

The startup, which helps developers build more complex applications on top of large language models, has raised between $20 million and $25 million in funding at a valuation of at least $200 million from Sequoia, according to four people with knowledge of the financing who were not authorized to speak publicly.

The most remarkable thing about LangChain is its community. Check out their Discord community (link in their Twitter profile here) and witness the infectious enthusiasm & creative energy of LangChain supporters. It’s a phenomenon.

III. Podcast of the Week: Founders Podcast on Steve Jobs

If I need a jolt of entrepreneurial inspiration, my first stop is David Senra’s Founders podcast. This week, he reviewed a new collection of the writing and talks of Steve Jobs (published by Apple as an ebook). It’s full of anecdotes and insights that reflect Jobs’ creative genius. This one goes into my “listen again in a few months” queue.

VI. Article of the Week:

Latent Space is my favorite source for AI news & insights. I highly recommend following LS creator Shawn Wang on Twitter. This recent post has a great overview of “Autonomous AI” and makes a strong case that autonomous agents are the Next Big Thing in AI. The post explains how agents are relatively easy to build and have a vast range of potential use cases.

V. AI News of the Week: Enter the Lawyers and Regulators

The innovation in AI continues to run red hot. If you can’t be innovative, the next-best strategy is to be litigious.

Reddit, Stack Overflow, and Twitter have all leveraged user-generated content to amass large data sets. None have launched innovative AI products with their data. This week they all announced that they will start charging for access to their data, presumably targeting companies who are innovating by training AI models.

Speaking of lawyers, in a rare moment of bipartisanship:

Several Republican senators are suggesting they are open to discussing how Congress can step in to regulate artificial intelligence systems after Senate Majority Leader Chuck Schumer, D-N.Y., announced he wants to put guardrails on the rapidly advancing sector.

Regulations - whether good or bad - create costs. That’s good for incumbents since they have resources to comply while startups generally don’t. So, I expect big tech will work with DC to produce legislation and it will help incumbents and hinder startups.

VI. Elon News of the Week:

This week, 73% of tech news was about Elon. We don’t normally do this, but a tech news round-up wouldn’t be complete without a quick tour through the Elon-iverse:

SpaceX had its first launch of the huge, new Starship rocket. It flew 3-4 minutes, then exploded. It seemed liked many in the media wanted to label it a failure. Yet SpaceX declare it a success. Given it continues to be miles ahead of the competition, I’ll take them at their word. This week’s All-In podcast discusses the launch and its broader implications for the space industry. I’m excited.

Tesla stock was down 9% on Thursday after soft Q1 earnings & announcing more price cuts. Meanwhile, some shareholders have accused Elon of being distracted.

Twitter’s removal of blue check marks created chaos. Microsoft dropped Twitter. from its ad platform. Elon threatened to sue.

Musk revealed TruthGPT, an AI initiative to challenge OpenAI. Oddly, a few weeks ago he advocated an AI freeze. Funny how fast things change with Elon.

In case you missed it, last month The Boring Company proposed to build 65 miles of underground tunnels in Las Vegas and Neuralink saw regulators sink its plans to test brain chips in humans.

Love him or hate him, Elon makes things happen. A few thoughts about his strategy:

His major structural advantages are low cost of capital & ability to attract great talent.

Being controversial works brilliantly. His devoted fans love his polarizing approach. They keep his cost of capital low (pre-paying for Teslas, etc) and that easy access to capital helps him maintain his talent edge - he can fund bold ideas that attract the most ambitious engineers.