Happy Saturday,

It was a wild and difficult week in the markets. While I won’t address it directly below, I feel terrible for SVB customers and even worse for employees. I posted a few thoughts here on LinkedIn.

There’s a lot to cover in this edition of the Weekly Update:

Market Update

Deal of the Week

Podcast Recommendation of the Week

Reading Recommendation of the Week

If you haven’t already, make sure to subscribe below.

I. Market Update: SVB Goes Down

It was a rough week for the markets. The WCLD plunged 10%, ending at $26.66. The NASDAQ was down 4%. Just about everything was down.

There was mixed news on inflation, but that didn’t matter much. The markets were dominated by the sudden and devastating collapse of Silicon Valley Bank. SVB was a top 20 bank in the US (based on assets) and banker for much of the tech industry.

What happened?

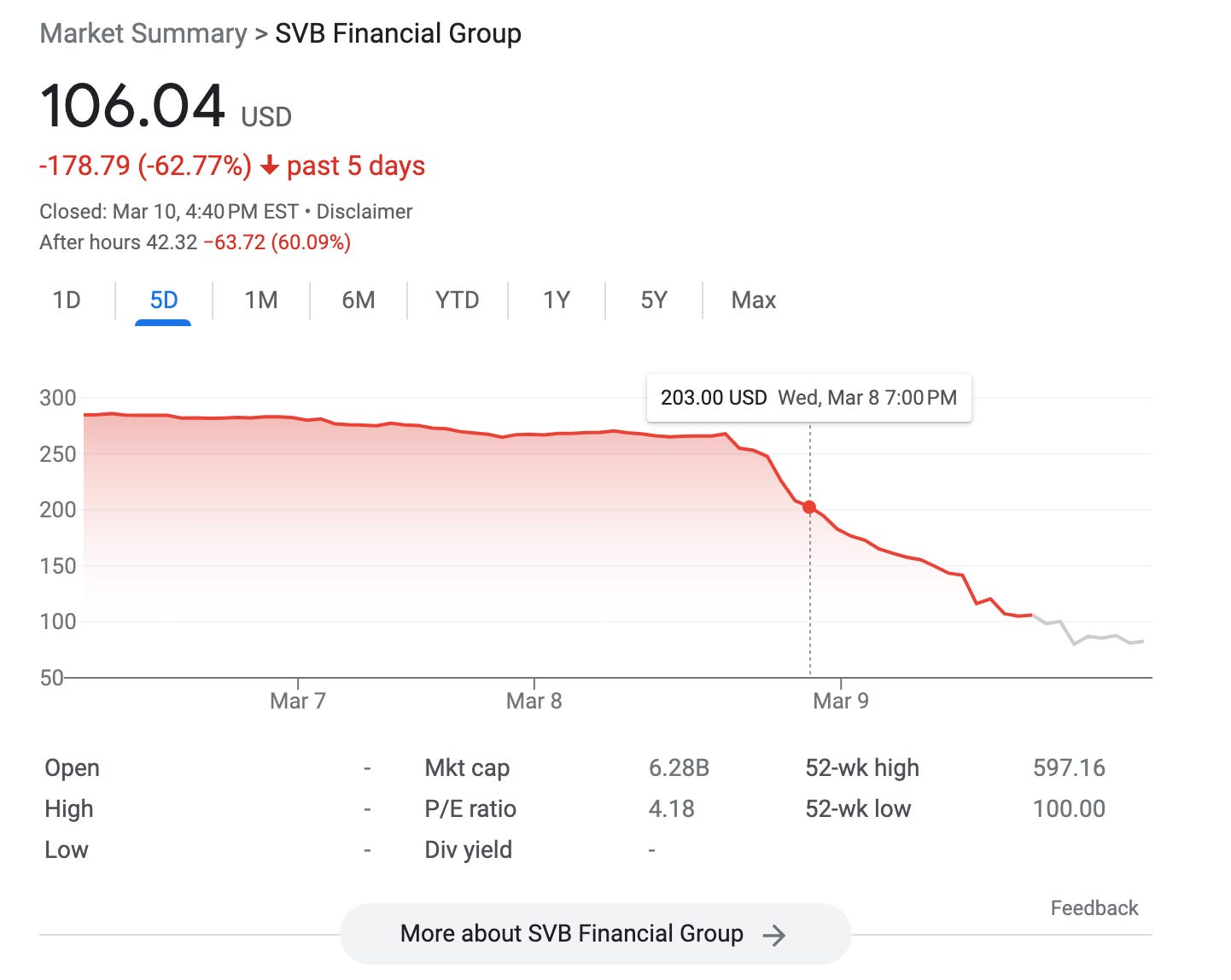

Below is the chart of SVB ($SIVB) over this past week. Nothing much happened to the stock on Mon. On Tue, it was down 6%. On Wed, the stock was down 4% at market close. Even at that late point in the week, it was hard to see the catastrophe lurking around the corner.

But then on Wed after the market close, something happened. I highlighted the point on the chart on Wed at 7pm, ET, when the stock had begun a severe after-hours slide. At that point, with the benefit of hindsight, we can see that the route was on. The stock was down 60% on Thu. In pre-market trading on Fri, shares were down 87%. The stock was halted at market open, so no trading occurred. A few hours later, regulators swooped in and shut down the bank. At that point, accounts were locked down. This was terribly challenging for SVB customers and much worse for employees.

OK, but what really happened?

An old-fashioned bank run, starting slowly on Wed and then accelerating on Thursday. It happened fast.

Looking back, we can see that SVB management made many blunders. For example, in 2021 they put a very large chunk of their assets — over $80b! — into long-term mortgage-backed securities (MBS) with an average yield of 1.56%. When interest rates moved up, those securities became worth much less. This gets quite technical, but they didn’t need to sell those assets (or mark them to market prices) until the run began. When account holders began their exodus on Wed and en masse on Thu, it forced their hand.

Sadly, SVB management utterly failed in arguably a bank’s most important job, to project stability.

In particular, SVB failed to project stability to their VC customers, who triggered the panic on Wed and Thu by warning their portfolio companies of potential risks with SVB.

So where do we go from here? Unfortunately, it’s not clear. There is a very high degree of uncertainty as I write this on Sat morning. The panic could continue. Because every bank is vulnerable to a bank run in a fractional reserve banking system. No modern bank, regardless of the contents of their balance sheet, can withstand a moment when all customers simultaneously want their money back.

While SVB was arguably the worst offender among large banks in buying MBS at the interest rate peak, they are not alone Just about every bank has MBS that are dramatically impaired by the spike in interest rates. Is there systemic risk in the financial system? The scary view:

Fortunately, many experts are less worried.

Let’s hope that regulators can quickly sooth the markets and calm the antsy customers of SVB’s peers. If they don’t, we could have another nasty week ahead of us.

This a moment when FDR’s famous maxim tells the story: “the only thing we have to fear is fear itself.”

II. Deal(s) of the Week: Qualtrics & Anthropic

It’s almost forgotten because of the SVB headlines, but a major deal was announced earlier in the week. The $12b private equity take-private of Qualtrics - I discussed it here:

This week, there was also a major fundraising in the AI space:

Spark Capital is leading a $300 million investment in artificial intelligence startup Anthropic, one of the primary startup challengers to OpenAI, at a pre-investment valuation of $4.1 billion, according to two people familiar with the matter. The deal follows a $400 million investment in the startup by Google, one of the people said.

Anthropic is building large language models (LLMs). This requires a lot of capital for servers and infrastructure. They are partnered with Google, which seems to position them well as an OpenAI alternative.

At these valuations, I’m not sure that VCs will do particularly well in their AI investments. But I’m certain that customers will be big winners as AI startups invent highly innovative new products.

III. Podcast Rec of the Week: Autobiography of Ray Kroc

Let me be clear: I listen to a lot of podcasts on tech, entrepreneurship, and venture capital. My favorite this week was David Senra’s Founders Podcast, where he reviewed the autobiography of Ray Kroc.

At the age of 52 in 1954, Kroc met with the McDonald brothers and signed a deal to grow their restaurant business via franchising. Kroc took the Mcdonald’s concept, improved it, and began an aggressive expansion strategy. He bought them out in 1961.

I’m inspired by Kroc’s incredible determination and the remarkable success he had after the age of 50. I’m only 43, so I have a solid 5-10 years to figure things out to be on the same pace as Kroc!

IV. Reading Rec of the Week: Google Playing Catchup in AI

One of the surprises in the recent AI boom is that Google has been behind Microsoft and OpenAI. Google has deep AI tech capabilities such as Deepmind, so there’s a chance they can catch up. Although reading this Bloomberg article on their plans made me worried:

Senior management has declared a “code red” that comes with a directive that all of its most important products—those with more than a billion users—must incorporate generative AI within months.

The last time Google had such a major, top-down mandate was in 2011. Back then, management decided they needed to infuse social into all of their products. Anyone remember how that worked out? Not good.

Granted, Google had very little expertise in social back then. This time around, Google is much better-positioned. But I can’t help be skeptical of any company trying to enforce innovation via top-down mandates. I think it will be better for customers if Google can legitimately compete with Microsoft and OpenAI, so I’ll be rooting for them to make progress.