Happy Saturday!

In this edition of the Weekly Update, you’ll find:

Market Update: Economy weak, but MSFT & META feast

Tech Deal of the Week: Pinecone raising like it’s 2021

Pod of the Week: Insights from a product-led sales guru

Read of the Week: Australia’s top VC on failure

AI Update: OpenAI & charging more for less

I. Market Update: Economy weak, but MSFT feasts

While the NASDAQ and S&P were both up in the 1-2% range, the WCLD sunk 5% to end the week at $26.64.

Economic data released this week showed that inflation is still lingering and the the economy is slowing.

Gross domestic product rose an annualized 1.1% in the first quarter, notably less than the median forecast for 1.9% in Bloomberg’s survey, Bureau of Economic Analysis data showed Thursday.

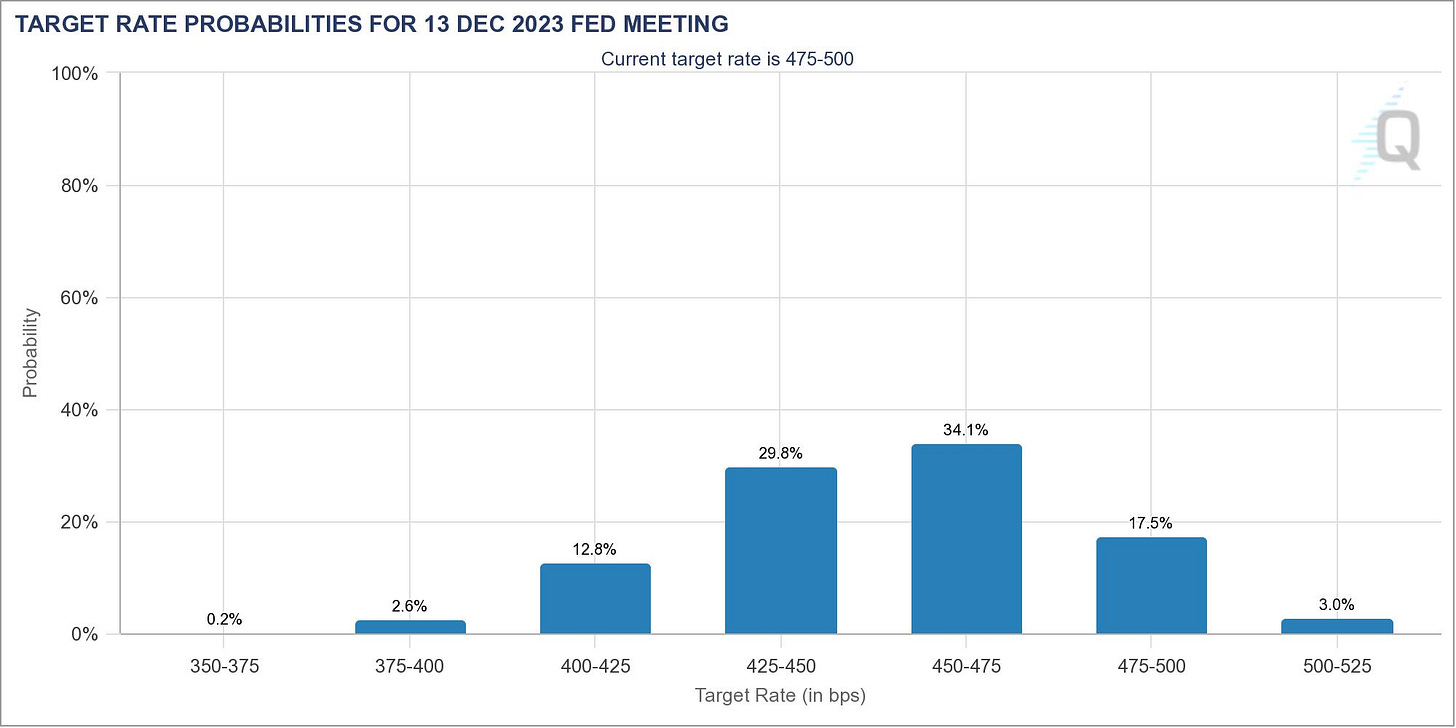

The inflation print all but assures that the Fed will hike from 5% to 5.25% next week. But the bond market doesn’t think these rates will last - it’s priced in at least 2 rate cuts this year. In other words, the bond market expects economic weakness to force the Fed to start cutting soon. The chart below shows that the market thinks there’s only a 3% chance the Fed won’t cut this year.

A recessionary economy would pressure earnings, but lower rates would be good for asset prices. The stock market’s recent strength suggests the bullish potential of rate cuts is outweighing the bearish potential of a recession.

Meanwhile, Microsoft reacted to the weak economic conditions with “Hold My Beer.” They announced strong earnings this week, sending the stock up 9% and adding a $186b in market cap.

Even though AI is just a blip on their P&L — VC Tomasz Tunguz estimates it’s at ~900m ARR, less than 1% of total revenue — excitement around AI played a big role in the stock’s big move up.

One other mega-cap tech company saw its stock surge this week as Meta was up 13% after its earnings. Not surprisingly, the company leaned into AI and the market welcomed it:

Amazon and Alphabet also had earnings announcements this week. Neither had the warm reception that Microsoft and Meta experienced. It’s a safe bet that next quarter, both Amazon and Google will place even more emphasis on their AI strategies.

II. Tech Deal of the Week: Pinecone raising like it’s 2021

ChatGPT and other text-based AI applications are powered by a particular type of generative AI technology known as large language models (LLMs). LLM usage is exploding. If you’ve used ChatGPT, you might have noticed there’s a problem. It’s like Adam Sandler courting the forgetful Drew Barrymore in 50 First Dates. LLMs have no memory.

Vector databases solve this problem. While Chroma and Weaviate are in the running, Pinecone appears to have an edge (for now) as the leader in this very dynamic category. They just raised $100m on a 750m post-money valuation.1

Pinecone CEO’s summarized their market position:

“We are clearly the creators of this category and the leaders in it. When we came out with this, with the vector database category, nobody knew what the hell we’re talking about. Now of course, this is a well-formed market and the category has different players, and so incumbents and clouds and so on, and we’re clearly ahead. And so it’s very easy to bet on the leader of a category that is already formed.”

III. Podcast of the Week: Elena Verna on Product-Led Sales

If you’re an early-stage SaaS company, do you know who is clicking on your Terms of Service (TOS) page? It’s worth tracking since it’s a potent signal of enterprise buying intent.

I got this insight from listening to an interview with product-led sales guru Elena Verna on Lenny’s Podcast. The podcast is full of useful tips & examples on how bottom-up/PLG startups can build their sales muscle.

VI. Read of the Week: Blackbird’s Niki Scevak on failure

Blackbird Ventures’ Niki Scevak has built one of the most impressive records in the global VC industry over the last decade. After founding Australia’s leading accelerator, Startmate, Scevak co-founded Blackbird Ventures, which has established itself not only as Australia’s leading VC firm, but one of the best firms on the planet (thanks to being the largest investor in Canva and many other breakout startups).

Scevak just wrote a wonderful essay on failure and its inevitable, painful, yet constructive role in the startup ecosystem. The whole essay is a must-read. Here’s the beginning:

Firstly, startup failure is a healthy ecosystem feature. Failure is a chance for talent to be routed within the ecosystem from failing companies to scaling ones or to prompt the formation of their own startup.

As with athletes, the brightest technical talent has a period of peak performance, and the world moves forward when they join teams that are succeeding, not when they are trapped in companies whose time hasn't come.

V. AI News of the Week: OpenAI & charging more for less

A funny thing about bottom-up software is the most expensive version typically does the least. The “enterprise” version typically includes security & privacy features that effectively limit a product’s functionality.

The standard bottom-up software product strategy:

Free → single-player mode (optimize for quick time-to-wow to attract a user)

Paid → multi-player mode (layer in collaboration to attract the user’s manager)

Enterprise → security & privacy (layer in access controls to attract the manager’s manager)

It’s counter-intuitive - few developers would expect the biggest budgets for their bottom-up product will come from restricting its capabilities. This is one of the reasons why monetization strategies in bottom-up software are emergent.

OpenAI seems to be tracking along this path. They recently announced that they will soon offer a business plat for ChatGPT that will be based on restricting it from improving based on interactions with users. The business plan will be for:

professionals who need more control over their data as well as enterprises seeking to manage their end users. ChatGPT Business will follow our API’s data usage policies, which means that end users’ data won’t be used to train our models by default. We plan to make ChatGPT Business available in the coming months.

OpenAI has been stunningly inventive - hence investors have been clamoring to invest at a $29b valuation. To OpenAI’s credit, they are not trying to reinvent a well-established bottom-up monetization strategy. I would expect this to help their revenue continue to grow rapidly for the foreseeable future. They’ll need it to justify their $29b valuation.

Quick digression: why that valuation? $100m is a nice, round number. The 750m post-money valuation means the round created 10% dilution. The company must have wanted to limit dilution to a nice, round 10%. Hence that valuation. That’s how VC valuation math works.